I've long been a critic of first and second generation Universal Life plans. Which is not to say that they didn't have a role to play, just that I think they required more "hands-on" attention by insureds than they were really prepared (or encouraged) to take on.

One of the biggest challenges to older plans is that they often become "upside-down;" that is, the internal costs far exceed the premium and interest credited, and they quickly become very expensive. Compounding this are IRS rules that effectively quash any hope of recovery by limiting premiums to a level where the policy just can't sustain itself.

The problem is that, if one doesn't really "goose" the cash value the first few years, then by the time the problem (insufficient cash value) becomes clear, it's too late to correct.

Or so I thought.

Turns out that although carriers can't illustrate level premiums sufficient to carry the policy forward, there's a stipulation in the tax code that if a policy violates IRS guidelines, once the cash value has been drained you can pay the premium needed to cover the monthly cost of insurance deductions/expenses. You just can't build a significant amount of cash value. So, you'd need to increase the premium each year as the cost of insurance deductions increase.

[ed: Link to relevant code is here, scroll down to 7702 f 6]

So, problem solved? Eh, to the extent that one can continue to pump cash into a quickly expiring insurance policy. The question then becomes whether that's really a good idea. Or it may be that this is the time to seriously consider selling the policy. Still, it's always nice to have options.

[Hat Tip: FoIB Sara S]

It's hard to believe, but in over 11 years of blogging, we've never talked about the 'split dollar' life insurance funding technique:

"A split dollar plan allows an executive to obtain life insurance coverage using employer funds. The investment by your business in the plan is fully secured. If the insured employee dies or his or her employment is terminated, your business is reimbursed from the policy proceeds for its payment of premiums."

Now, why would an employer want to offer this? Well, it's a way to reward valuable employees (executives, key supervisors and the like) in a way that, unlike most benefits, doesn't require offering the same deal to everyone. Basically, the two parties (employer and employee) split the cost of coverage using whatever permanent type of coverage is appropriate (Universal or whole Life, for example).

It's an economical way to help a favored employee afford more long term coverage, and acts as "golden handcuffs" to entice him to stay. The concept itself has been used successfully for many years, and is generally well-accepted by the IRS.

But one can "up the ante" a bit by adding an "Inter-Generational" twist. These arrangements are generally family-directed. For example:

An elderly and permanently incapacitated mother acquired, on a lump-sum basis, life insurance on each of her three sons. The Tax Court was asked if this "would be deemed a taxable gift to the extent that the premium payment exceeds the value of current life insurance protection."

That is, since the death benefit of the insurance policies would always be greater than the (one-time) premium paid, would that premium be taxable? The Court actually ended up ruling that it wouldn't.

Now, why is this interesting to those of us who don't have extremely wealthy (and desperately ill) parents? Because it reaffirms the basic value of the split dollar concept itself and, who knows, perhaps you'll one day be that wealthy orderly parent.

Not to mention that emphasizing the need for well-thought-out estate planning.

A month ago, I blogged on a client whose premium was jumping from about $700 a month to $1,000. One of the options we discussed was "going bare;" that is, declining to buy any insurance. Now, he could have potentially then become subject to the ObamaTax, but even that is a small fraction of what that increase represents.

He ultimately chose to keep his existing coverage (since he'd already met his annual deductible and was anticipating some additional expenses), but our discussion really brought me up short.

It wasn't that long ago that I castigated the subject of a newspaper article for making the choice to roll the dice by deciding not to be insured.

So what changed?

Everything, really: under the UnAfforable Care Act, it seems to me that choosing not to buy insurance is a rational choice. Although I would never advise going this route (cf: E&O coverage) there are certainly circumstances in which I don't argue very forcefully on its behalf.

Let's take Max: his current plan comes with a (low, by today's standards) deductible, after which covered expenses are paid at 100%. If renewal wasn't an option, he would likely be looking at a $4,000 deductible plan with a monthly premium of $852. Which means paying out over $14,000 (on an annual basis) before the insurance paid penny one.

Well, that's not quite true, either: the first dollar benefits include an annual checkup, which is worth some small fraction of that $14 large. Oh, and birth control and maternity, as well. For a 64 year old guy.

He'd save about $700 in ObamaTax penalties, as well.

But you see where this is going, right? It's absolutely a reasonable, rational choice to take a pass on an ObamaPlan altogether. And I hate that I not only see this, but (reluctantly, to be sure) agree with it.

/sigh

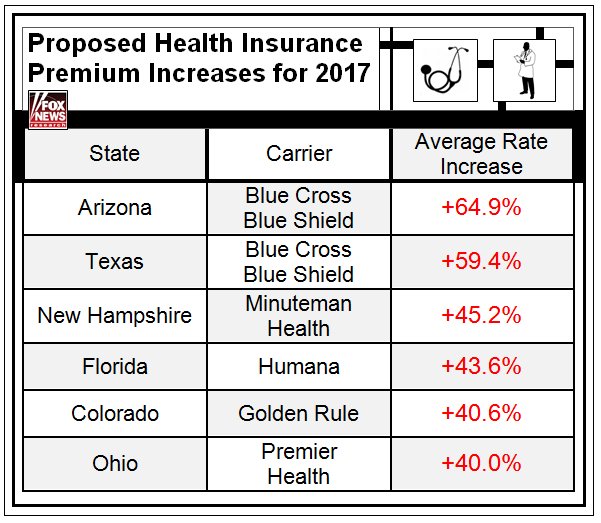

It will come as no surprise to those who've been paying attention that the (Un)Affordable Care Act has been an unmitigated disaster. But it may surprise some to learn of the scope of said disaster:

"While clear evidence that the law was expanding coverage, the soaring enrollment numbers have created a fiscal nightmare for insurers which, in turn, has serious consequences for customers."

I might take issue with the assertion that more folks are insured since the train-wreck passed, but that's for another post. The key is the make-up of those newly-insured:

"A majority of new enrollees are considered high risk, meaning insurers will have to spend more money on people in poor health and requiring expensive care."

This just makes sense, since when one is in dire need of health care it's human nature to seek out ways to help pay for that care. The problem is that there's no truly effective way to cushion that by enticing healthy folks to play along, except to keep moving inexorably toward a nationalized, government-run system (aka Single Payer).

Which works out so well.

It's been a while since we've checked in with those fun-loving rascals running the Much Vaunted National Health Service©. Last time we checked, those silly pranksters were busy ignoring the desperate pleas of a woman left to die by her "caregivers."

But that was then, and this is now, and they've moved on to much more productive things.

Such as denying necessary (if not urgent) surgeries, including hip replacements and cataract procedures. It's not they're they're being intentionally negligent, it's just that - get this - they've run out of money.

Hunh.

If you're a government-run health care system and you go broke, that's a problem, no?

But no worry, it'll never happen here.But it's not just "routine" procedures getting tanked, ER's are taking hits, too:"Shortage in emergency doctors leading to A&E crisis ... We have reached a crisis point"

So say the folks in charge of United Lincolnshire Hospitals.

Oh, those rascally nationalized health "care" schemes.

[[Hat Tip: FoIB Holly R]

One of the most significant problems with ObamaCare is that, at its heart, it's not really 'insurance.' The definition of insurance is that it's a method for assessing, and then minimizing, the pain of risk. And yet, the Rocket Surgeons in DC© who designed it managed to remove all but one risk factor (tobacco use). Couple that with the fact that folks with subsidies aren't even paying their own premiums (a necessary pre-condition of "spreading the risk") and, well, you can begin to appreciate the scope of the problem.

But it gets worse: plans also include any number of so-called "first dollar" benefits: services and products that are paid for regardless of whether one has met the out-of-pocket limit (thus "free"). These include, for example, mammograms and birth control convenience items, pap smears and the like.

Notice, though, that there is not one single male-oriented bennie to be found. Zip, zero, nada.

And yet the Top Brains at The Commonwealth Fund have the audacity to claim that ObamaCare hasn't really been that great for women:

"[G]aps in women’s health coverage persist. Insurers often exclude health services that women are likely to need."

Right.

Here's my favorite:

"Six types of services are frequently excluded from insurance coverage: treatment of conditions resulting from noncovered services"

Are you kidding me?!

What part of "noncovered services" do you not understand. Of course noncovered services aren't ... covered.

And the rest of this drivel goes on in similar vein.

My friend and colleague David W offered this assessment:

"Start with the idea of "insurance" is to pay for everything. That's not insurance, that's an entitlement or a prepaid health plan[ed: as noted above]. Move on to what that costs, when insurance is already too expensive and going up, and when you move to specifics, note that 5 of the 6 "uncovered" procedures were covered by 80% of the plans, and 6th by 60% of plans. Finally, consider "choice" vs "control" and understand that, at its core, this is a pathetic attempt to force other people to pay for services that they want - they just don't want to pay for them."

Indeed.